property tax advisor uk

25 years experience specialising in dealing with the. The current Stamp Duty Land Tax threshold for residential properties is 500000 up to 31 March 2021.

Best Accountants In Manchester Dns Associates

Regardless of when you were born everyone will have the same.

. Questions Answered Every 9 Seconds. Residence and non-residence issues. Specialist UK tax advice and self-assessment tax return preparation for non-residents and expats from Andrew Baker Taxation Consultant.

Ad Cross New Borders With Confidence. Stamp Duty Land Tax Act 2015. For non-residential land and properties the threshold is 150000.

As a busy landlord you know that time is money and UK property. From 1 April 2021 The. Property tax - residential.

Stamp duty land tax SDLT Tax investigations. Solid dependable and mostly unlikely to take big dips in value. We ask clients to complete the meeting form with as much details as possible so that all the.

Since 2006 weve been advising residential homeowners on all things Stamp Duty Land Tax SDLT with over 15 million reclaimed from HMRC. Make The World Your Marketplace With Aprios Intl Tax Planning Services. Landlords can book time with our property tax specialist right from the comfort of their homes.

Ad Talk To Us About Taking Advice - Financial Advice Thats Always On Your Terms. A property accountant is charged with the task of tracking all cash activity for a property as well as working with property managers to accurately account for tenats. Gain access to full bespoke tax advice from qualified experts in London designed to guarantee mitigation and compliance with your tax in the UK.

Rebecca Busfield CTA MA Oxon. We are specialist taxation consultants and business advisors exclusively for landlords and property investors in the UK. Our property accountants and tax advisors have specialist skills in advising businesses and individuals and can deliver commercial and practical solutions to help maximise profits.

Ad A Tax Agent Will Answer in Minutes. Accounting firm Accountant Bookkeeping service Payroll Service Provider Tax advisor Tax Preparation. Ad A Tax Agent Will Answer in Minutes.

Finance Local Property Tax Act 2012. Ad Talk To Us About Taking Advice - Financial Advice Thats Always On Your Terms. Clients In 50 Countries.

Questions Answered Every 9 Seconds. Using this solution you can. For the current tax yean the personnel allowance is 11500 and it will be increased for the next tax year 2018-19 to 11850.

Property Tax Advisers - Property Tax Advisers. The UK Property Tax advice includes from Statutes and the major case Law such as. With the rental market extremely healthy its also a good way to generate a second.

Property is one of the safest investments.

What Is Buy To Let Tax And Why Should I Care Youtube

![]()

Tax Accountant Resume Sample Guide 20 Tips

How To Reduce Avoid Uk Property Tax 5 Quick Tips Youtube

As Local Accountants Dns Accountants Offering All Types Of Accounting Services For Small Business In The Surround Tax Accountant Accounting Services Accounting

17 Property Tax Return Tips Uk Self Assessment Youtube

The Complete Guide To The Uk Tax System Expatica

Inheritance Tax Advice For Expats And Non Uk Residents Expert Expat Advice

What Is Buy To Let Tax And Why Should I Care Youtube

How To Reduce Avoid Uk Property Tax 5 Quick Tips Youtube

How To File Your Uk Taxes When You Live Abroad Expatica

Tax On Airbnb Income Uk Property Accountants Property Tax Specialists

Matthew Ledvina Started Us Uk Tax Company

The Complete Guide To The Uk Tax System Expatica

What Is Buy To Let Tax And Why Should I Care Youtube

Shaz Nawaz Managing Director Aa Chartered Accountants Linkedin

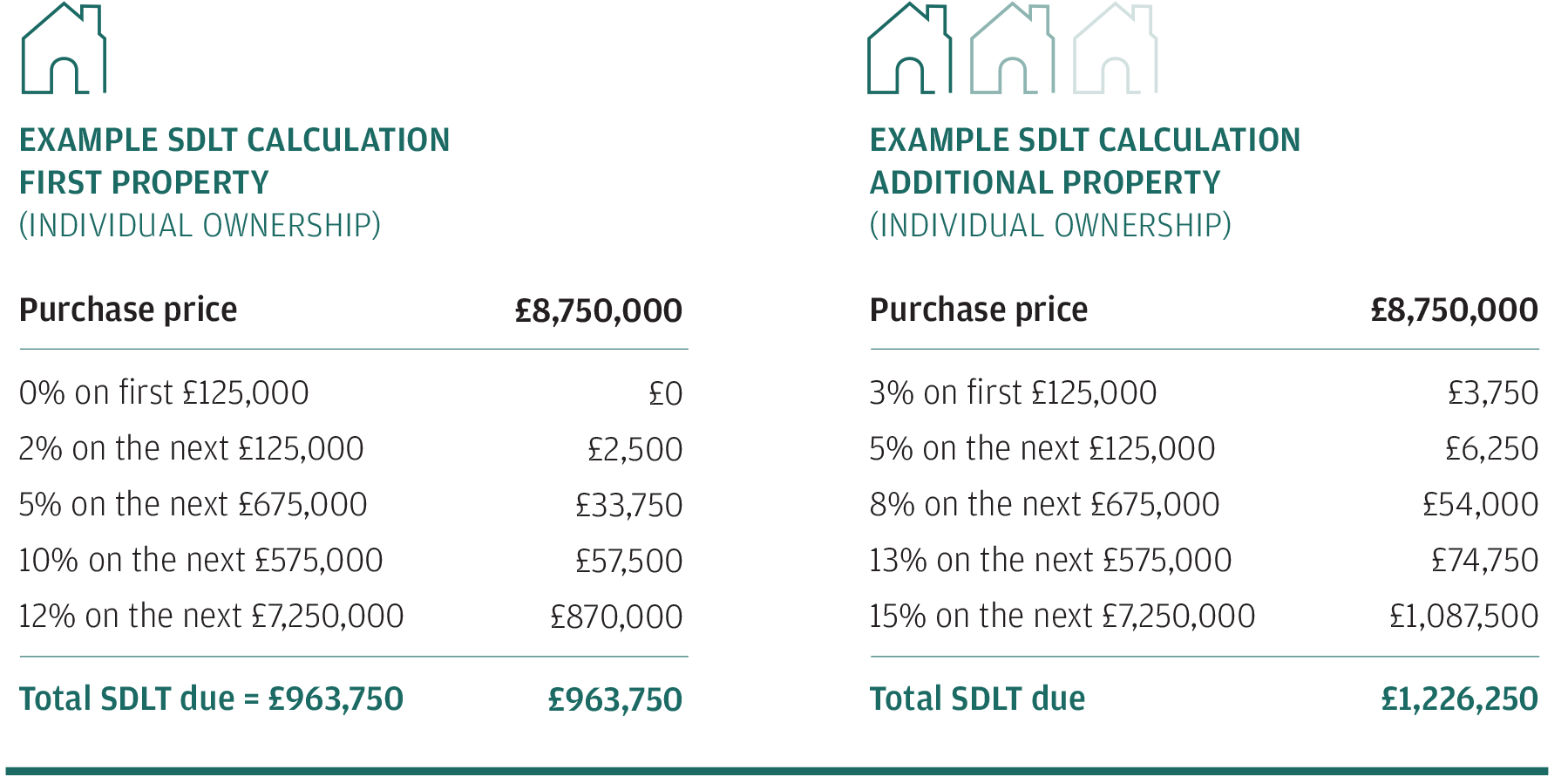

Buying Residential Property In The Uk J P Morgan Private Bank

Mark Barrett Consultant Accountant Riverview Portfolio Ltd Linkedin

What Is A Tax Advisor Skills Qualifications And Getting Started Coursera